Accounting Documents

The document is a paper that proves the actual occurrence of a particular financial transaction. Before recording the financial transaction in accounting books and records, it is quite important to ensure that the documents proving the occurrence of the financial transaction are available.

The Importance of the Document

- The document is used as a means of proof to validate the financial transaction.

- The document is used as legal evidence in the event of disputes.

Types of Accounting Documents

Accounting documents can be divided into direct documents and indirect documents as follows:

Direct Documents:

Direct documents are the documents directly prepared by the company, and are considered the main source of recording in the accounting books. They are as follows:

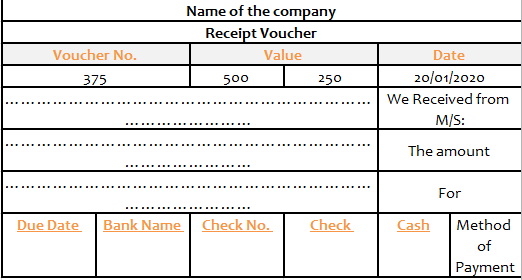

Receipt Voucher

Receipt Voucher represents a document which the company habitually issues when it receives payment from the customer in cash or by bank check, so that the payer gets a copy of such voucher, while the other copies are kept at the company for recording the financial transaction in the accounting books. The following is a sample Receipt Voucher.

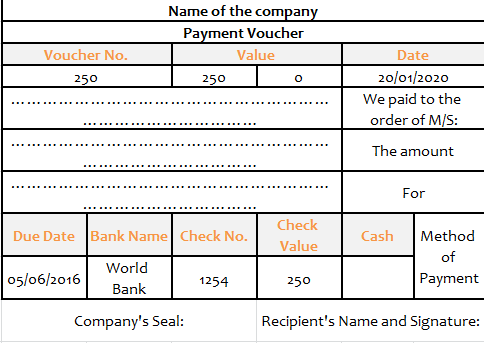

Payment Voucher

Payment Voucher represents a document which the company usually issues when it makes payment in cash or by a bank check, so that the recipient of the payment gets a copy after signing it, while the other copies are kept by the company for recording the financial transaction. The following is a sample Payment Voucher.

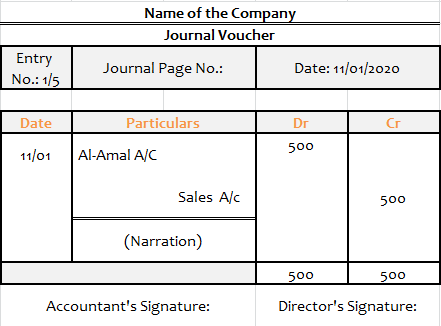

Journal Voucher

Journal Voucher represents a document which the company issues when a financial transaction occurs and does not involve payments or receipts, so that the transaction will be subsequently recorded in the accounting books, such as the credit sales transaction (sale on credit).

Indirect Documents:

Indirect documents represent the supporting documents which are attached with the direct documents as a means to prove the financial transaction, and are as follows:

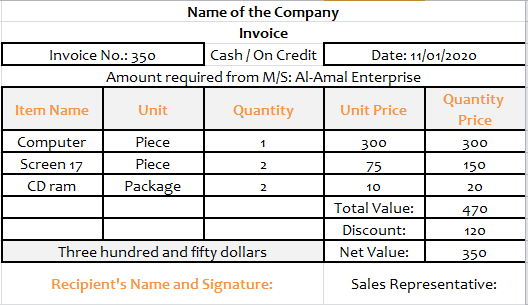

Invoice

The Invoice is a statement which the seller issues and contains an in-depth description of the service provided or the goods sold and their quantity, total value…etc. For the seller, the invoice is a sales invoice, while for the buyer, the invoice is a purchase invoice.

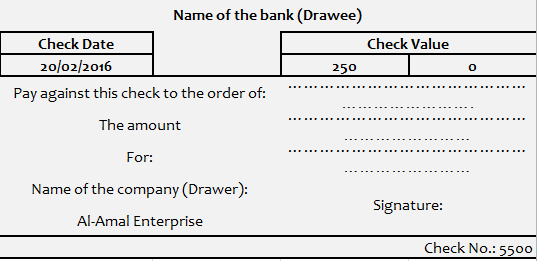

Check [Cheque]

The Check is a written instrument containing an order directed to the bank by the bank account holder (The Drawer) to pay a sum of money to a Third Party known as The Beneficiary, so that once the Beneficiary receives that check from the bank account holder, he brings it to the bank, and the latter then pays the amount to the Beneficiary after it is debited from the drawer's bank account.

Bill of Exchange [BOE]:

The bill of exchange is a written promise by which a person undertakes to pay a particular sum of money on a specified date to another person known as the Beneficiary. There might be one or two guarantors, as needed.

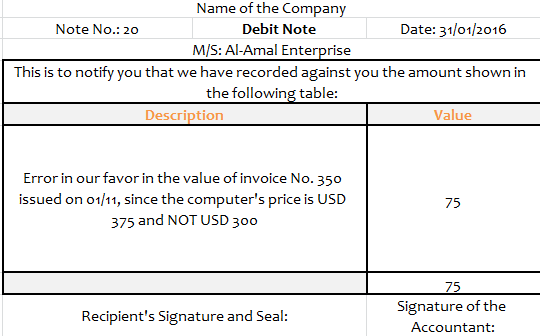

Debit Note

The Debit Note is a statement sent by the company to the customer to inform the latter that the value of the claim due has been increased as a result of providing an additional service or due to a particular error.

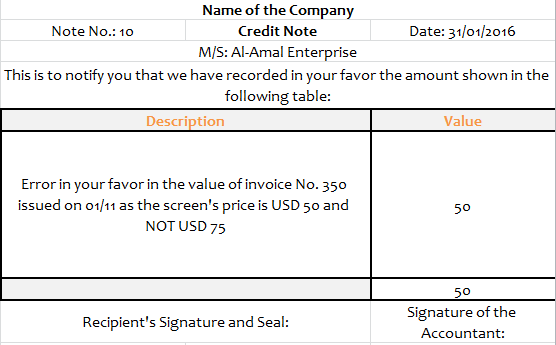

Credit Note

The Credit Note is a statement sent by the company to the customer to inform the latter that the value of the claim due has been reduced due to the occurrence of a particular error or for any other reason.

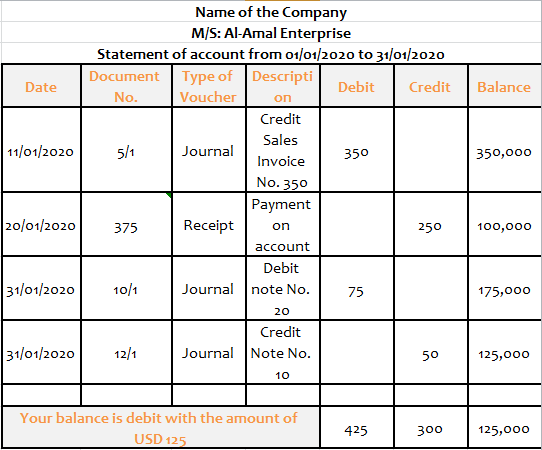

Statement of Account

The Statement of account is a statement which the company issues and sends to its customers, showing the balance due, debit and credit movements that occurred within a particular fiscal period.